HSAs: 7 elements to include in your education strategy to help spark employee action

This is the last in a series of three articles highlighting insights and research from our latest Voya Perspectives Orange Paper, Amplify the power of HSAs to boost health care savings — now and in retirement. Read the other articles:

- 7 tips for effective health savings account HSA program design

- When it comes to retirement savings, don’t forget about HSAs

In our recent article, we discussed the benefits of Health Savings Accounts (HSAs) for both employees and employers. Our goal is for employees to achieve higher savings amounts and lower tax bills with HSAs — but know this is possible only if they fully understand how to use them.

Our latest Voya Perspectives paper explores the value of HSAs on long-term retirement readiness, but few truly understand the financial opportunities they can provide. While these tax-advantaged accounts can play a role in boosting employee financial wellness in the present and future, a 2023 Voya survey found that only 55% of employees knew HSAs could be used to pay for health care expenses in retirement.1

The good news is employers can take steps to close this knowledge gap by helping employees understand HSAs better. Employers need to show how these powerful financial tools:

- Can help employees save for health care expenses — whether they happen today or later in life.

- May help improve the employee’s overall financial wellness.

- Are practical supplements along with their retirement savings plans.

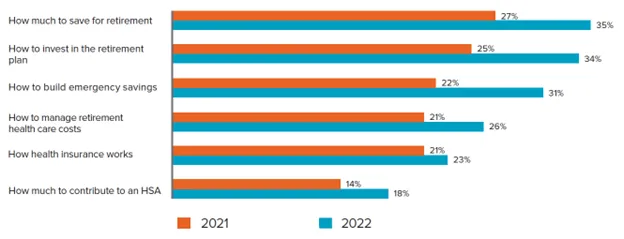

Employees are ready to not only have access to good workplace benefits, but to actually understand them. According to the 2022 EBRI/Greenwald Workplace Wellness Survey, there was a noticeable increase from 2021 in the number of employees indicating they want financial advice from their employer in the areas of saving, investing and health care:

Employees increasingly want education and guidance from employers2

Providing robust benefits education may sound like a daunting task for employers. Luckily, HSA providers, benefits brokers and financial professionals are equipped to help. And, of course, having a solid communication strategy is critical.

7 elements of an effective HSA education strategy

Incorporating specific HSA education into your overall benefits communications plan is more than expecting employees to read and comprehend product brochures. Voya suggests that employers consider including these 7 key components for an effective HSA education strategy:

1. Personalized messaging

The messaging you use to educate your employees should be as diverse as they are. Messaging strategies should be informed by employee life stages, which benefits they’re enrolled in and their experience with benefits in the past.

2. Actionable steps

Along with tailored messaging, you should provide simple steps to help employees act. Small steps like increasing contributions or committing to long-term savings can have real, measurable impacts on their financial wellness.

3. The inevitability of unplanned medical expenses

Accidents happen, and there is never an opportune time to take on medical debt. By sharing how HSAs can help ease the financial (and perhaps mental) load of eligible medical costs, employees may be more motivated to start contributing to their HSAs each pay period.

[callout] 60% of full-time workers are stressed about their finances and experience negative impacts on their health and wellness, according to PwC’s 2023 Financial Wellness Survey.3

4. Using HSAs in retirement

When employees think about their retirement savings, they’re likely not thinking about HSAs – and that they can carry an HSA balance over from year to year, which is how they can accumulate for retirement. By highlighting this feature, employees can begin to better leverage their employer benefits. They can play an active role in closing the retirement health care savings gap.

5. Explanations on tax advantages

HSAs are triple tax-advantaged — but many people may not understand what that means. Be sure to take time to clearly explain how saving in an HSA can lower their tax bills now and in the future.

6. Introductions to HSA investing

The same type of investing education and guidance provided to employees for their retirement plan can apply to HSA investing. Make sure you have a similar investment guidance strategy for both types of plans. As with any investment, there are risks; accountholders should make sure to fully explore those risks before choosing to invest.

7. Integrated decision-making guidance

It’s common for employees to make workplace benefits and retirement savings decisions independent of each other. But that shouldn’t be the case. Providing an integrated guidance experience can help employees see the big picture during open enrollment and beyond.

Here are additional HSA education tools employers can use to help educate employees:

- Risk-assessment questionnaires – Analyze benefit options and offer guidance across all product lines.

- Future value calculators – Show how HSA contribution levels and investment performance can potentially affect long-term account growth.

- Data analytics, artificial intelligence, machine learning and wellness apps – Provide decision-making support.

- Digital technology – Can increase the speed, accuracy and integration of benefits information from multiple providers.

Connecting health and financial wellness

At Voya, we believe the future of benefits lies in connecting the dots between health and wealth decisions. And employees agree: 84% of workers are very/somewhat interested in a digital tool that allows them to see all of their financial and employer benefits information in a single place.4

A comprehensive decision-support tool could help employees more fully understand their options. Giving employees a way to view HSAs and their other benefits spend alongside their retirement account options can help get their workplace benefits and savings in sync.

That’s why we developed the myVoyage® personalized enrollment guidance experience. It gives employees personalized support and actionable steps throughout the year, so they can see the bigger picture and how their health benefits can directly impact their savings.

About Voya and our “Orange Papers”

As a workplace benefits and savings provider, Voya knows the dynamics that surround people’s health plans and financial accounts. We aspire to clear the path to financial confidence for more fulfilling lives, so we thoughtfully design our products and services, including our HSAs, to be easy and engaging for employees.

Part of this vision is to better understand how providers, intermediaries and employers can help individuals improve their financial outcomes. Our Voya Perspectives Orange Papers share our research findings and guidance for industry-wide innovations.

It’s clear, HSAs are an under-utilized account option — and for everyone to get the full benefits of these accounts, some work must be done. By incorporating employee HSA education into their strategy, companies may be able to help drive engagement and success.

Learn more about Voya’s HSA offerings and read the full Voya Perspectives Orange Paper: Amplify the power of HSAs to boost health care savings — now and in retirement.

Text representation of article graphics (for screen reader accessibility):

Graphic 1: Employees increasingly want education and guidance from employers2

| 2021 | 2022 | |

| How much to save for retirement | 27% | 35% |

| How much to invest in the retirement plan | 25% | 34% |

| How to build emergency savings | 22% | 31% |

| How to manage retirement health care costs | 21% | 26% |

| How health insurance works | 21% | 23% |

| How to contribute to an HSA | 14% | 18% |

- Based on results of a Voya Financial Consumer Insights & Research survey conducted with Morning Consult between March 9-15, 2023, among n=500 working Americans age 18+ who have both an employer-sponsored retirement plan and a medical/health plan, featuring n=188 health savings account owners.

- EBRI and Greenwald Research, Workplace Wellness survey, n= 1,518, 2022.

- PwC, 2023 Employee Financial Wellness Survey, 2023.

- Voya Consumer Insights & Research survey conducted June-July 2023, among 6,176 retirement plan participants serviced by Voya.

Neither Voya® nor its affiliated companies or representatives provide tax or legal advice. Please consult a tax adviser or attorney before making a tax-related investment/insurance decision.

Voya Financial and its affiliated companies (collectively, “Voya”) is making available to you the Personalized Enrollment Guidance tool offered by SAVVI Financial LLC. (“SAVVI”). Voya has a financial ownership interest in and business relationships with SAVVI that create an incentive for Voya to promote SAVVI’s products and services and for SAVVI to promote Voya’s products and services. Please access and read SAVVI’s Firm Brochure which is available at this link: https://www.savvifi.com/legal/form-adv. It contains general information about SAVVI’s business, including conflicts of interest.

The Personalized Enrollment Guidance tool provides information and options for you to consider in making healthcare, health savings, emergency savings, and retirement savings choices. Those choices are solely up to you to make. Personalized Enrollment Guidance is not intended to serve as financial advice. None of SAVVI, Voya, nor WEX Health acts in a fiduciary capacity in providing Personalized Enrollment Guidance or other services to you; any such fiduciary capacity is explicitly disclaimed.

Products and services offered through the Voya® family of companies.

Health Account Solutions, including Health Savings Accounts, Flexible Spending Accounts, Commuter Benefits, Health Reimbursement Arrangements, and COBRA Administration offered by Voya Benefits Company, LLC (in New York, doing business as Voya BC, LLC). HSA custodial services provided by Voya Institutional Trust Company. For all other products, administration services provided in part by WEX Health, Inc.

This highlights some of the benefits of these accounts. If there is a discrepancy between this material and the plan documents, the plan documents will govern. Subject to any applicable agreements, Voya and WEX Health, Inc. reserve the right to amend or modify the services at any time.

The amount saved in taxes will vary depending on the amount set aside in the account, annual earnings, whether or not Social Security taxes are paid, the number of exemptions and deductions claimed, tax bracket and state and local tax regulations. Check with a tax advisor for information on whether your participation will affect tax savings. None of the information provided should be considered tax or legal advice.

Investments are not FDIC Insured, are not guaranteed by Voya Benefits Company, LLC (in New York, doing business as Voya BC, LLC), and may lose value. All investing involves risks of fluctuating prices and the uncertainties of return and yield inherent in investing. All security transactions involve substantial risk of loss.