Eligibility Fast Pass process means speedier Stop Loss claims turnaround

Enables as many as 10-plus days faster claims reimbursements

If you travel frequently, you may have experienced the advantages of a “pre-check” process that can help you get through airport security lines faster.

Now, we are providing a similarly expedited experience in the form of faster reviews for Stop Loss Insurance customers who file a claim. Thanks to our recently launched Eligibility Fast Pass process — available at no additional cost for all employers with our Stop Loss coverage — we can make claims payments as many as 10+ days faster than when following our traditional eligibility process.

How it works: Eligibility Fast Pass with “preferred census” information

The new Eligibility Fast Pass process allows us to review initial claims with basic eligibility information that’s provided via what’s known as a “preferred census.” When these additional data points are used in conjunction with the regularly required census, we can review most claims without the usual process of pending the initial claim, sending a request for eligibility, and awaiting the information to be provided.¹

Pending the claim typically adds 10+ business days to the process while we wait to receive the requested eligibility information.

Not needing to pend the claim means we are able to review and process an eligible claim payment 10+ business days earlier, compared to the traditional path.

Benefits include the potential for faster payments and reduced administrative burden

Stop loss customers who take advantage of the Eligibility Fast Pass process can expect benefits such as:

- Faster turnaround time for complete claim review, decisions and reimbursement.

- Fewer pended claims, claim delays and points of friction in the claim review process overall.

- Removed or reduced administrative eligibility emails between the client, broker and Voya.

Innovation in action

In every area of interaction with our customers, we strive to simplify, integrate and optimize the experience to save time and improve outcomes. With our Stop Loss Insurance product, the new Eligibility Fast Pass process helps us deliver on these goals by enabling self-funded employers to get critical, high-cost claims reimbursements faster, with less administrative hassle.

To learn more about our Stop Loss Insurance and the new Eligibility Fast Pass service, contact your Voya representative today.

Text representation of article graphics (for screen reader accessibility):

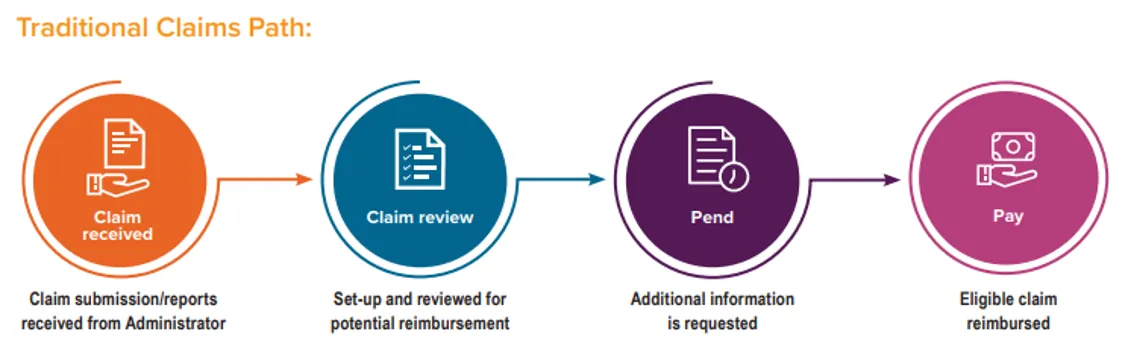

Graphic 1: Traditional Claims Path

- Claim received: Claim submission/reports received from Administrator

- Claim review: Set-up and reviewed for potential reimbursement

- Pend: Additional information is requested

- Pay: Eligible claim reimbursed

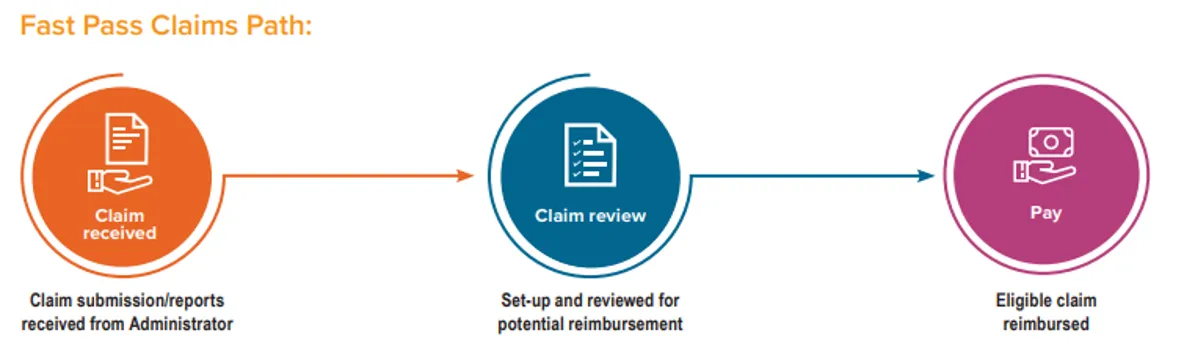

Graphic 2: Fast Pass Claims Path

- Claim received: Claim submission/reports received from Administrator

- Claim review: Set-up and reviewed for potential reimbursement

- Pay: Eligible claim reimbursed

- Please note, some claims may require additional information that we will reach out for on an as-needed basis. Examples of such information are active at work status, confirmation of premium payment when claimants are on leave, etc. Actual results may vary. Eligibility Fast Pass is not insurance coverage.

Excess Risk Insurance is issued by ReliaStar Life Insurance Company (Minneapolis, MN) and ReliaStar Life Insurance Company of New York (Woodbury, NY). Within the State of New York, only ReliaStar Life Insurance Company of New York is admitted, and its products issued. Both are members of the Voya® family of companies. Policy Form #RL-SL-POL-2013; in New York Policy Form #RL-SL-POL-2013-NY. Form numbers, availability and specific provisions may vary by state.