Voya Financial Offers Every Baby Born Today a $500 Mutual Fund Investment

NEW YORK, Oct. 19, 2015 /PRNewswire/ -- Voya Financial, Inc. (NYSE: VOYA), announced today that it is promoting the company's second annual Voya Born to Save campaign. This means every baby1 born in the United States today, October 19, 2015 — the first working day of National Save for Retirement Week2 — is eligible to receive a $500 mutual fund investment from Voya.3 The program was introduced last year as a way to support the national savings event and help the next generation on its path to retirement readiness.

Experience the interactive Multimedia News Release here: http://www.multivu.com/players/English/7446753-voya-born-to-save-campaign/

"While retirement is still a distant milestone for a baby, the goal of Voya Born to Save is to underscore a simple but important point — that it's never too early to start planning and saving for the future," said Charlie Nelson, CEO of Retirement for Voya Financial. "We are pleased to help the many babies born today who will one day be working towards their own financial goals. We also want to encourage all Americans to think differently about how they can prepare for retirement. Voya is committed to helping individuals get ready to retire better by planning, investing and protecting their savings."

According to U.S. Census data, more than 10,000 babies are born each day in this country. Voya will honor all babies born today with a complimentary $500 investment upon their enrollment in the program. Meanwhile, approximately 10,000 Baby Boomers turn 65 every day, a trend that is expected to last for the next 15 years. Voya's campaign reminds everyone to save early and often in order to capture the benefits of long term investing.

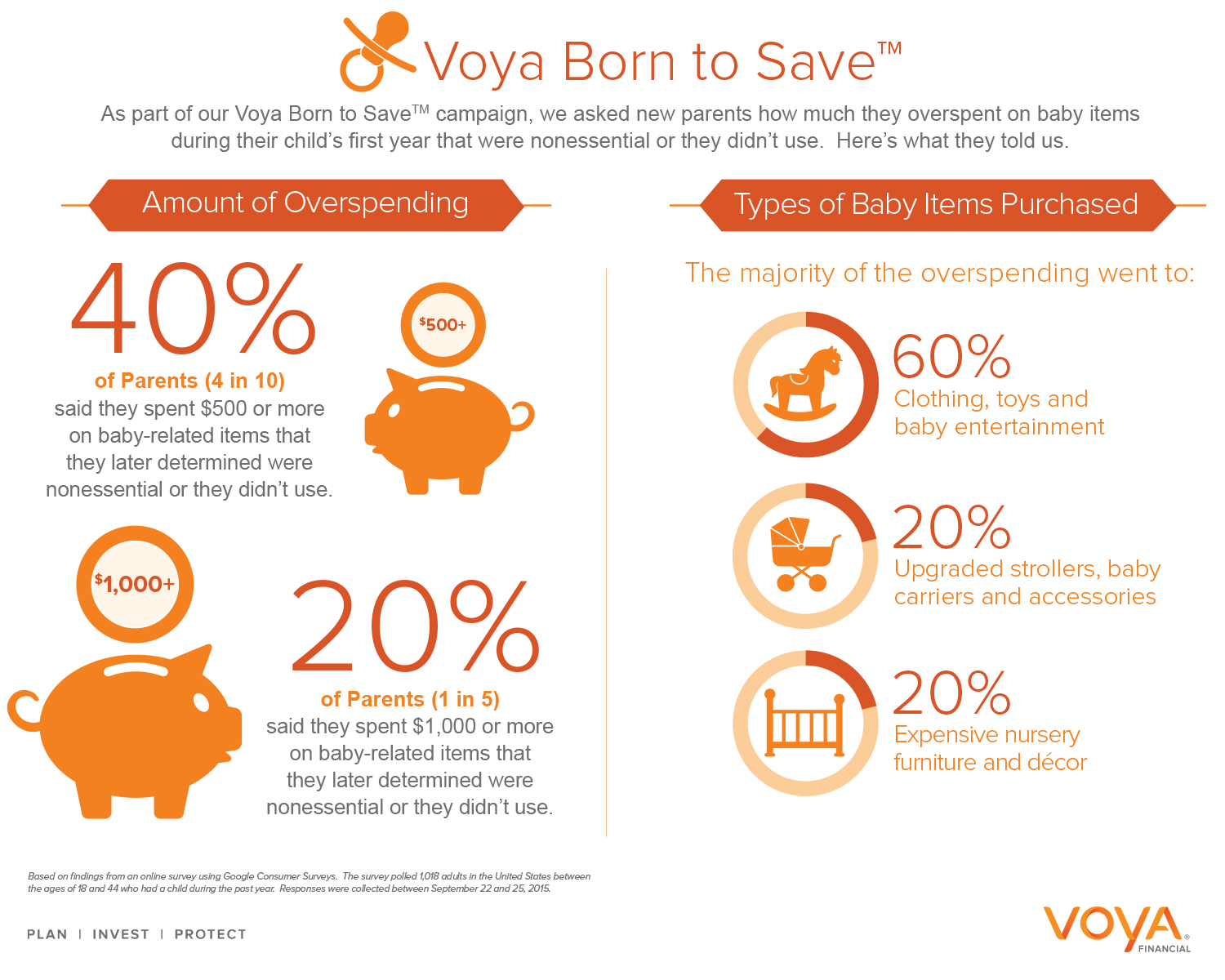

Even new parents may find a few extra dollars to save

In a recent survey4 of more than 1,000 new parents, Voya found that roughly four-in-ten (40%) spent at least $500 on baby-related items in the first year that they later determined were nonessential or they never used. Nearly one-in-five (20%) of the moms and dads spent over $1,000 on these items. The survey also found that a majority of this over-spending (60%) went to clothing, toys and baby entertainment, while approximately one-in-five (20%) went to upgraded strollers, baby carriers and accessories. A similar amount (20%) also went to expensive nursery furniture and decor.

"We recognize that families have many competing financial priorities in life, which can make saving for retirement even more challenging," noted Nelson. "But what these findings show us is that as difficult as the saving process can be, there may always be a way to find some extra dollars to earmark towards retirement. Whether it's cutting back on the more expensive items, setting and sticking to a budget, or making sure to pay your retirement plan first, the goal is to make regular contributions whenever you can — no matter how large or small — every step of the way."

A special birthday gift for the 'Class of 2014'

To further reinforce the benefits of consistent saving, Voya is also giving each Voya Born to Save baby from the Class of 2014 their own savings gift. More than 1,000 families established an account for their children in response to last year's inaugural campaign. Tomorrow, October 20, 2015, is their first birthday and Voya will deposit an additional $50 mutual fund investment into their existing accounts.

"We think this birthday gift is a great reminder that saving for retirement requires regular attention, planning and contributions," added Nelson. "While the realities of life can get in the way — especially for new parents during the early years — we encourage everyone to find simple ways to make saving a priority."

To learn more about the Voya Born to Save program, and to find out if a newborn you or your family welcomed on October 19, 2015, is eligible to receive a complimentary $500 mutual fund investment, please visit http://voya.com/borntosave. Parents and guardians of eligible babies must register for this offer by December 18, 2015.

As an industry leader and advocate for greater retirement readiness, Voya is committed to delivering on its vision to be America's Retirement CompanyTM and its mission to make a secure financial future possible — one person, one family, one institution at a time.

1. Subject to complete Terms and Conditions including U.S. citizenship/residency requirements.

2. National Save for Retirement Week is an industry-wide savings initiative that was renamed National Retirement Security Week in September 2015. Both the original and the new names are being used during 2015 to promote the campaign.

3. Mutual funds distributed by Voya Investments Distributor, LLC – 230 Park Avenue, New York, NY 10169.

4. Based on findings from an online survey using Google Consumer Surveys. The survey polled 1,018 adults in the United States between the ages of 18 and 44 who had a child during the past year. Responses were collected between September 22 and 25, 2015.

|

Media Contacts: |

|

|

Joe Loparco |

Bill Sutton |

|

Voya Financial |

Voya Financial |

|

Office: (860) 580-2677 |

Office: (860) 580-2626 |

|

Cell: (860) 462-6525 |

Cell: (315) 373-9685 |

About Voya Financial®

Voya Financial, Inc. (NYSE: VOYA), helps Americans plan, invest and protect their savings — to get ready to retire better. Serving the financial needs of approximately 13 million individual and institutional customers in the United States, Voya is a Fortune 500 company that had $11 billion in revenue in 2014. The company had $484 billion in total assets under management and administration as of June 30, 2015. With a clear mission to make a secure financial future possible — one person, one family, one institution at a time — Voya's vision is to be America's Retirement CompanyTM. The company is equally committed to conducting business in a way that is socially, environmentally, economically and ethically responsible — Voya has been recognized as one of the World's Most Ethical Companies, by the Ethisphere Institute, and as one of the Top Green Companies in the U.S., by Newsweek magazine. For more information, visit voya.com or view the company's 2014 annual report. Follow Voya Financial on Facebook and Twitter @Voya.

SOURCE Voya Financial, Inc.